What is Synthetic Identity Theft?

Scammers create fake identities and establish new credit accounts by combining stolen real identifying information with fake information; or using fake information such as fictional children, a practice called identity farming.

Synthetic identity theft is challenging as cybercriminals often target children. Children’s social insurance numbers are more often desired because children don’t usually establish credit until adulthood, making it more likely to go unnoticed. Cybercriminals then attach fake information to the stolen SIN numbers such as a false name, date of birth, or address, allowing them to apply for credit lines. They may even create social media profiles to add credibility. Read more about this as we dive into the details of synthetic identity theft.

How it could affect you

If someone uses your SIN to work illegally or to obtain credit you may:

- Be liable to pay additional taxes on income that you did not actually receive

- Have difficulty obtaining credit because someone may have ruined your credit rating

- Be liable for expenses that were incurred in your name, or by using your social insurance number

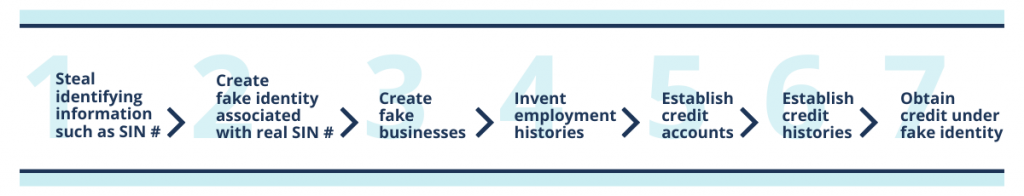

How it’s done

Typically thieves create a fictional identity by combining a real SIN number with a fake (often slightly altered) name. Due to the way information gets collected and stored, variations in credit files occur naturally, and SIN numbers may be associated with more than one name due to misspellings, typos, or name changes after marriage.

Thieves exploit these variations to establish credit histories for fictitious persons by creating fake businesses to establish credit accounts and to invent employment histories.

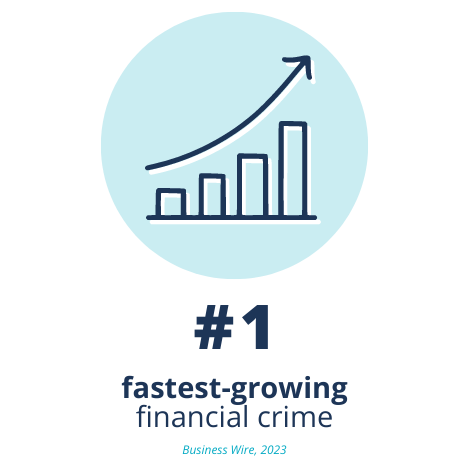

By the Numbers

Synthetic Identity Fraud Represents 88.3% of all identity fraud events, and is the fastest-growing financial crime of 2023 according to the U.S. Department of Justice.

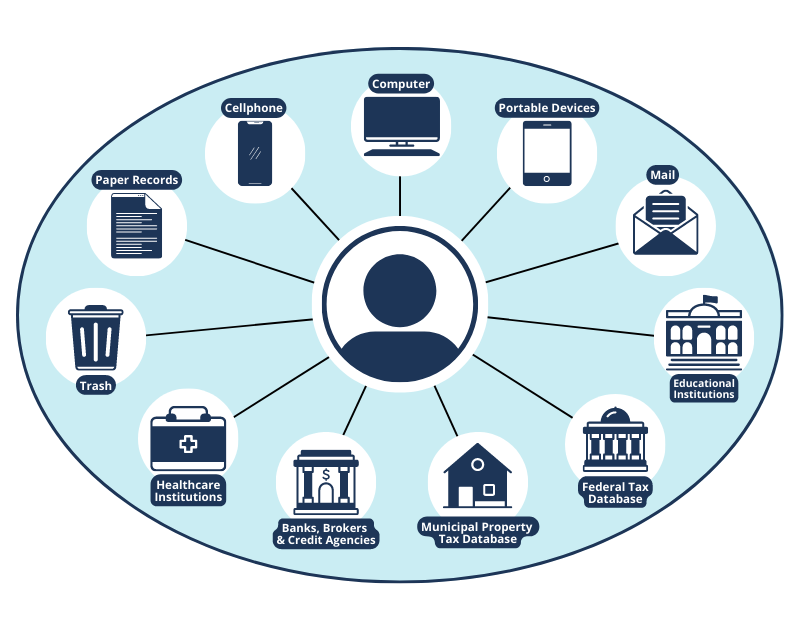

who has your sIN number?

Many institutions outside of your control have your SIN number, and once they have them you’re at the mercy of their protection measures.

Be proactive by checking if these institutions have been breached.

What you can do

Monitor your SIN #

Memorize your Social Insurance Number (SIN).

Don’t carry your SIN card.

Never reveal your SIN to anyone unless you are certain the person asking is legally entitled to that information.

Scrutinize Credit Denial Letters

If you get turned down for credit, make sure the lender or credit card company based their decision on your identity and personal credit information.

Check for variations of your name.

Credit Report

Get a free copy of your credit report from Canada’s two national credit bureaus, and review it for any suspicious activity.

Equifax: 1-800-465-7166 | TransUnion: 1-800-663-9980

Place a Fraud Alert on your Credit Report

A fraud alert makes it more difficult for unauthorized accounts to be opened in your name.

It requires creditors and lenders to verify your identity (e.g., by phone) before opening a new credit account in your name or making changes to an existing account.

Check for Suspicious Mail

Be on the lookout for mail sent to your home address with someone else’s name, change-of-address notices, and any credit offers with variations of your name.

Notify the credit bureaus of your correct name. Contact Canada Post if you didn’t initiate an address change.

Guard your Personal Information

Shred all paper records containing personal information.

Protect your electronic information with confidential passwords.

Store your tax returns, bank and credit card statements and other paper records in a safe place.

Claudiu Popa discusses Synthetic Identity Theft on CBC News Now

What to do After an Identity Theft

If you have been the victim of identity theft, or suspect that your information may have been compromised you need to secure your accounts and information immediately. This tip sheet outlines who to notify and how.

Why Should You Report Scams And Frauds?

Your information could link a number of crimes together, in Canada and abroad. Your Information could progress or complete an investigation. Reporting helps make crime trends more accurate and allows for crime forecasting. It helps law enforcement, private and public sector, academia etc. to learn about the crimes and help with prevention and awareness efforts. Check out our reference guide on reporting scams and frauds.

Courses for everyone

Register for our Cybersafety Academy

Welcome to the KnowledgeFlow Cybersafety Academy! FREE and available to all, our academy offers a wide range of courses on topics like data privacy, secure online communication and how to spot scams. With simple, easy-to-understand content and practical applications, our platform creates a welcoming and supportive learning community. Gain the confidence to navigate the digital world safely and securely.